owner's draw in quickbooks self employed

Choose Lists Chart of Accounts or press CTRL A on your keyboard. Youre allowed to withdraw from your share of the businesss value through an owners draw.

Quickbooks Premier Could Not Open Data File Error In 2021 Quickbooks Open Data Data

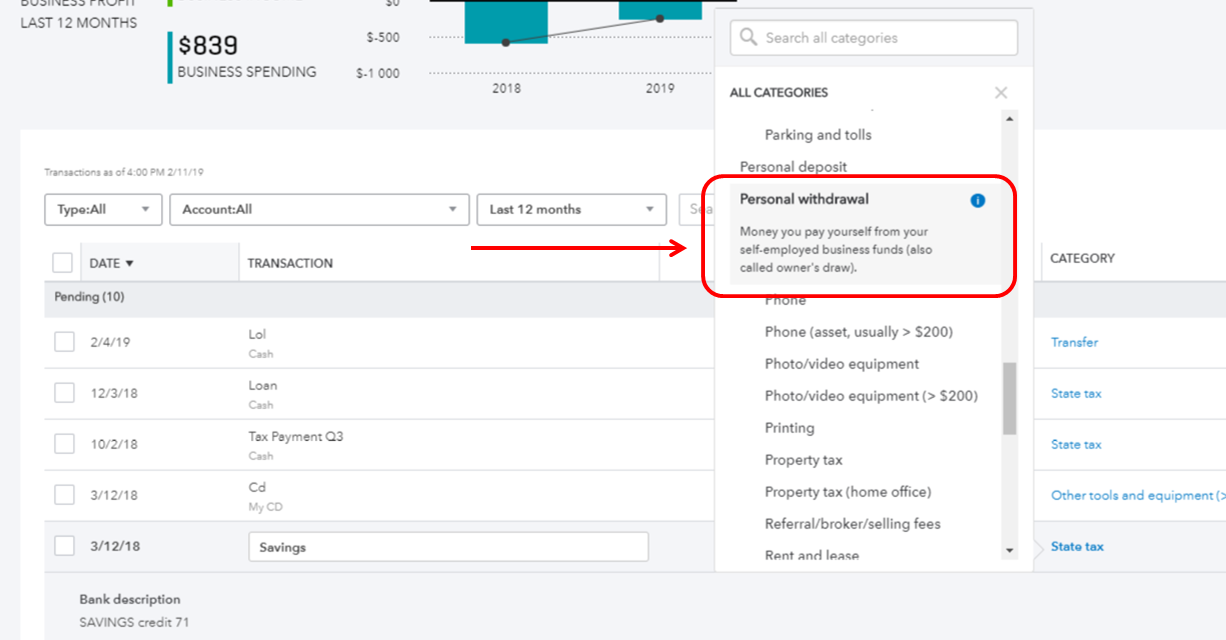

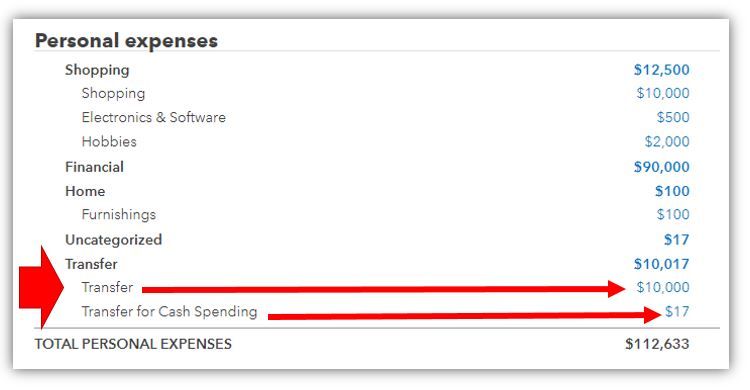

A draw lowers the owners equity in the business.

. Type the owners name if you want to record the withdrawal in the Owners Draw account. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. Up to 32 cash back At the end of the year your taxable income would be 40000 the profits from the business which your draws wont reduce.

Ad Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. The draws do not include any kind of taxes including self. Business owners generally take draws by writing a check to themselves from their business bank accounts.

An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like. The IRS will tax this. If you dont create payroll you can write yourself a Draw check remember to use the equity account in your Chart of Accounts that is for draws dont get hung up on the.

Pros of an owners draw Owners draws are flexible. If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the. A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company.

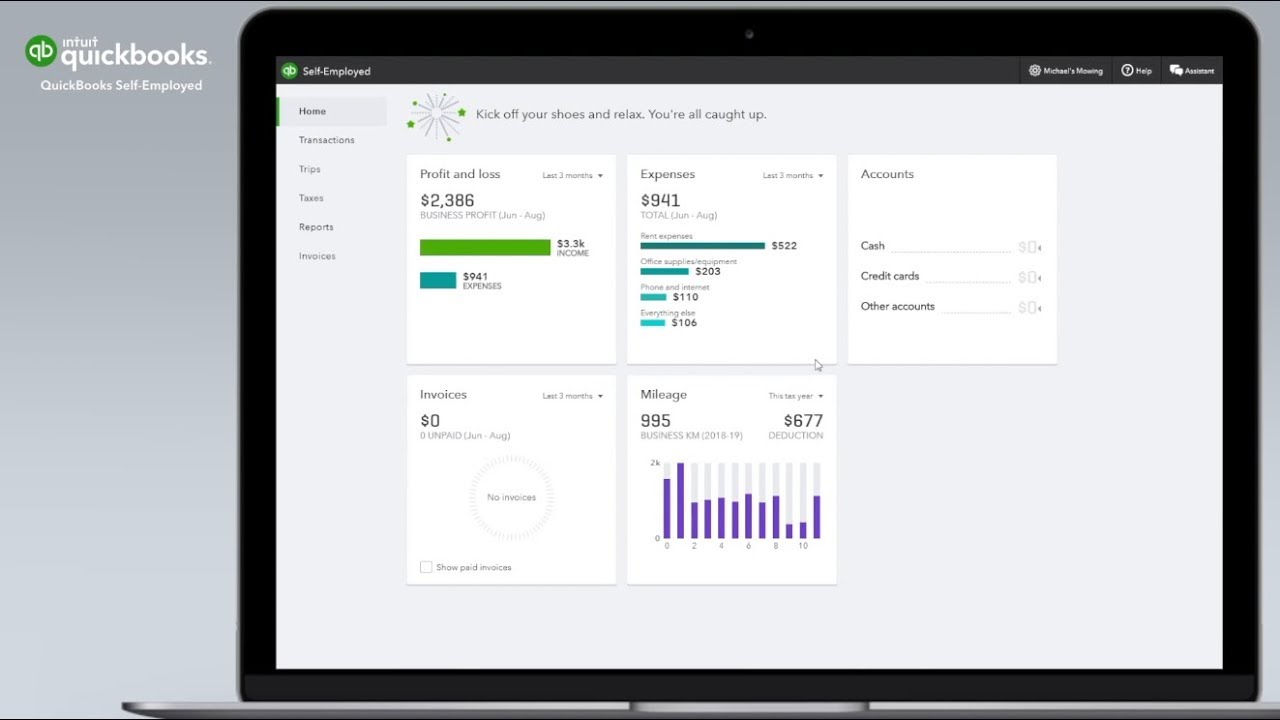

There is a mismatch in this situation. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. Help with Owner Salary or Draw Posting in QuickBooks Online.

Select Petty Cash or Owners. An owners draw is a one-time withdrawal of any amount from your business funds. You have an owner you want to pay in QuickBooks Desktop.

Ad Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. Instead you make a withdrawal from your owners. Owners Draw on Self Employed QB.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. See How QuickBooks Saves You Time Money. Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account.

Start Your Free Trial Today. At the end of the year or period subtract your. QuickBooks Self-Employed QBSE does not have a Chart of Accounts where you can set up equity accounts unlike QBO.

They can only draw. However owners cant simply draw as much as they want. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. An owner of a sole. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business.

Say you open a company with your friend as equal partners each putting up. See How QuickBooks Saves You Time Money. Start Your Free Trial Today.

Step 4 Click the Account field drop-down menu in the Expenses tab. As a business owner you are required to track each time you take money from your business profits as a. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

What comes in your clients account should be listed in the LLC account. For accounting purposes the draw is taken as a negative from their business. Because the LLC gets the money not your client.

What is an owners draw. Details To create an owners draw account.

What Is An Llc What Are The Advantages And Disadvantages If You Are Starting Up A New Business Selling Your Soc Business Finance Business Savvy Business Tips

How To Categorise Expenses W Quickbooks Self Employed On The Web Youtube

Accept Paypal Payments Quickbooks Desktop Quickbooks Quickbooks Online Paypal

How To Track Mileage Quickbooks Self Employed Youtube

Quickbooks Self Employed Review 2022 Carefulcents Com Business Tax Small Business Bookkeeping Small Business Finance

The Ultimate Quickbooks Online Year End Checklist 5 Minute Bookkeeping Quickbooks Quickbooks Online Bookkeeping Business

Quickbooks Enterprise 5 Features For Receipt Management Quickbooks Management Enterprise

Quickbooks Self Employed Complete Tutorial Youtube

Freshbooks Review 2018 Try Cloud Accounting Software Free For 60 Days Careful Cents Freshbooks Accounting Software Small Business Accounting

Quickbooks Self Employed Why I Went All In One Organized Business With Alaia Williams Quickbooks Business Organization Financial Planning For Couples

Solved Owner S Draw On Self Employed Qb

Taking Self Employed Drawings How To Record Money Your Pay Yourself Using Quickbooks Online Youtube

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help

Solved How Do I Add Cash Payments Into Quick Books

Solved Owner S Draw On Self Employed Qb

Setup A Draw From Quickbooks Self Employed

The Ultimate Quickbooks Online Year End Checklist 5 Minute Bookkeeping Quickbooks Quickbooks Online Bookkeeping Business

Quickbooks Self Employed Complete Tutorial Youtube

Quickbooks Self Employed Review My Most And Least Favorite Features Youtube